LS-Bank

is a full solution for automation of banking activities.

The

system is built around a unified accounting nucleus and supports all functions

of both the country’s Central (National) Bank and any commercial bank.

The

system operates under DBMS Oracle 8.1 and Windows NT platform. The front-end

applications are implemented with Borland C++ and Oracle PL/SQL.

LS-Bank supports user interface

and data entry in three languages (depending on a particular user’s

preference): English, Armenian and Russian.

The user interface language is chosen by the user at the setup phase, whereas

the data entry language may differ from one entry form to the other.

LS-Bank

has extended access control features. The

access control system has definitions of user, user role and user group. A user

may have several roles and belong to several user groups. The rights of a

particular user are defined by unification of the rights of his/her roles and

participated user groups. Each user or a user group has access to only those

objects and functions, which are allowed by the Security Service. Each entry

form, window, page, menu item, button, account, client, report, record owner

(each record in the database has its owner – creator or master), etc. are

considered as a separate object for access. This allows configuration of the

system according to the tasks of a particular user.

Any

change in the database

is logged

on the level of triggers with registration of the user who did the change and

the date/time stamp. For each and every record of the database the system

tracks all changes since the record’s creation. This means that for any given

moment of time the database status can be restored.

The

whole data entry process passes

several levels of verification and authorization

(this may be configured according to a particular Bank’s requirements), e.g.

most important data entry operation may get verified by a double entry, get

signed by inspectors/managers after visual verification, etc.

The

transactions are first reflected on the account limits and only after required

authorization are reflected on the account balance and general ledger balance.

For

multi-branch banks the system provides communication

between the head office and the divisions. The system has a

classical three-star structure. The main functional logic is implemented in

PL/SQL. The Application Server undertakes only caching in the local network and

for remote users. The data exchange is implemented via Windows Sockets (TCP/IP)

by Borland Midas technology. The whole database is organized with orientation

to branches (i.e. almost every table has a “Branch” field). The information

from branches to the bank’s main database is transferred either online, via the

application server (if the branch works directly with the Oracle server of the

main office), or, if the Oracle server is placed in the branch – using special

import-export feature. The branch application server caches the data received

from the main server when working online or gets the data from the local Oracle

server, i.e. the branches work according to one of the following schemas:

·

Main

Oracle Server

®

Main Application

®

Branch Application

®

Client

·

Branch

Oracle Server

®

Main Application

®

Client.

Oracle

server means the server along with software implemented in PL/SQL.

Switching

from branch to the other is done through switching the Oracle context, i.e.

each branch has access only to its own subset of data.

All

financial information in the database is kept in a form of

pairs of date/time stamp and value,

which allows both executing transactions and generating analytical reports.

The

control over the date of executing financial operation has only administrative

implication as any operation for any date is

correctly reflected in the general ledger balance.

The

required complementary information about the financial operations is reflected

on the technical accounts, which gives the system users a universal and handy

tool for controlling the bank’s operation and getting reports on its

activities.

The

System of Limits allows setting different types of limits on an account or a

group of accounts. The list of the limit types can be expanded by the user.

LS-Bank

supports several report

formats: Crystal Reports, MS Excel,

Formula1 Book, and Quick Report. All reports are generated into separate from

the system’s database files, and therefore, the list of available reports is

easily expandable by the user. Nonetheless, when a report is generated, any

requested piece of information should pass the access control system. In all

these reports the financial and other functions (view, cursors) prepared in

PL/SQL can be used.

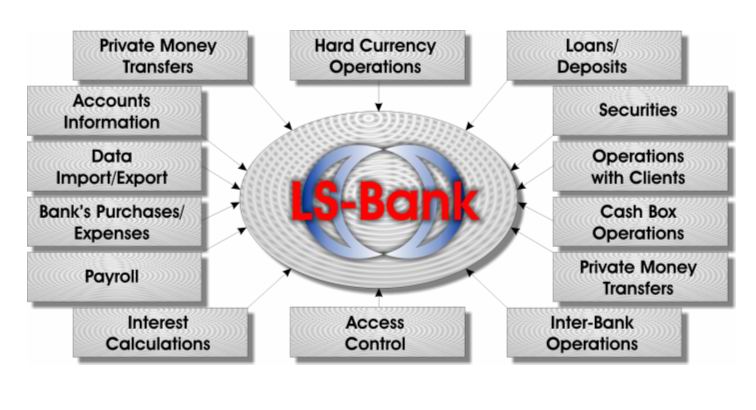

LS-Bank

includes the following subsystems:

·

Accounts Plan

·

Customers Look-up

·

Customer Services:

o

operations with customers,

o

operations with cash,

o

private money transfers,

o

loans and deposits,

o

securities,

o

inter-bank operations;

o

hard currency operations.

·

Operations with correspondent accounts

·

Document Flow Control:

o

checking for existence

of funds on the payee’s account when entering a document;

o

data entry

verification via double entry of key parameters;

o

search for a document

by any set of parameters and for any valid date;

o

generation of various

reports on documents;

o

collection of

information on flow of funds on face and balance accounts.

·

Currency Operations:

o

every foreign currency

account has two balances: in that currency and in the national currency;

o

reevaluation of the

hard currency accounts;

o

document entry

according to a special exchange rate – different from the official exchange

rate set by the Central Bank;

o

for each registered

hard currency the system allows calculation of the balance, reflecting

operations in a particular currency, as well as information for any set of

currencies;

o

automation of the

bank’s currency exchange offices

·

Loan-Deposit operations

provide entry into the system and control on different types of loans and

deposits: short term, long term, with different interest and principal payment

schedules, credit lines, repot and reverse repot agreements. The system

supports any kind of guarantee for loans (including different types of

collateral). Interest is automatically calculated and added-up according to the

loan agreement, as well as supports capitalization of the interest. Any changes

(change in payments schedule, interest rate, calculations in case of late

payments) in the loan agreement can easily get reflected in the system. The

system keeps the whole history of the loan: all changes in the loan agreement,

changes in the interest rates, payments of the interest and the principle, etc.

Any loan operation whether it is a financial or non-financial gets

authorization.

·

Securities Module

supports tracking the deals on purchase, sale and pay-off of discount and

coupon securities, including pay-offs with irregular payment schedules,

automatic add-up of interest earned, etc.

·

Inter-Bank Transfers/Payments Module

supports making and receiving transfers/payments to/from correspondent accounts

with import/export feature which supports most popular formats: SWIFT, the

National Data Format, telex, different specialized systems. The system internal

data storage format (accounts, banks, amounts, object names) fits the SWIFT

standards, which allows easy support of any format similar to SWIFT.

·

Private Money Transfer Module

supports sending and receiving of money transfers to individuals.

·

Automatic Execution of Standard Operations:

o

of reevaluation of

hard currency accounts;

o

of writing off the

incomes and expenses;

o

of calculation and

add-up of interest on loans, credit lines, deposits and other accounts.

·

System of Limits

allows setting on any account different limits, list of which is expandable by

the user.

The

following picture shows the structural schema of LS-Bank: